BANKING INDUSTRY NOT FUNCTIONING

Banks are also significant users of financial technologies that employ economic and statistical models. This new wave ushered in a modern outlook and tech-savvy methods of working for traditional banks which led to the retail boom in India.

What Are The Problems And Theses Proposed In The Field Of Ethics Of Banking Procedures Corporate Social Responsibility

Unlike other stores and shops banks are selling services rather than products.

. Learn more about the role that banks play in shaping economies their. In the modern world the banking industry plays a large part in financial dealings as it is a major and popular means for investing borrowing and storing money. The financial crisis has allowed stronger banks to buy other banks and companies that provide other financial services at lower prices than before the crisis.

Go home at 4 of functioning. Total global assets climbed to. 15 That consolidation meant many banks became too big to fail.

Lending Money to people in the form of Loan. The banking industry is an enormous sector of business and finance that has existed in human civilization in some form for thousands of years. You can also follow these troubleshooting steps to make sure your connection credentials are up to date.

The banking sector is an industry and a section of the economy devoted to the. You also gain a lot of knowledge about other industries as you spend a lot of time with your clients. Indian Banking Industry was completely shooked with the new policy.

Banking has some of the best exit options in the corporate world. It may only be a matter of time before the provision of commercial and retail credit already. Banks are commercial institutions and need to increase their business.

The bank performs a number of secondary functions also called as non-banking functions. The banking industry handles finances in a country including cash and credit. Banking Industry Overview.

Their primary function is to accept deposits and grant loans to the general public corporate and government. Her expertise covers a wide range of accounting corporate finance taxes lending and personal finance areas. A bank is a financial institution which performs the deposit and lending function.

1949 and their business model is designed to make profit. The bank performs a number of agency functions which includes - Transfer of Funds Collection of Cheques Periodic Payments. With the growing economy in many developing countries as well as our own and with the continuous growth in population there will continue to be a growing need for banks to hold and loan money to make monetary transactions and to keep hiring people.

A bank requires to satisfy the central bank that its affairs are not carried out in a way. The Imperial Bank of India established on January 271921 was renamed as the State Bank of India on July 11955 after passing of the State Bank of India Act 1955. Similarly the bank lends to a person who needs money investorborrower at an interest rate.

Which of these is not a function of Public Sector Banks. The federal government was forced to bail them out. Ii The State Bank of India.

Only the Reserve Bank of India controls the issue and flow of currency. A popular career service conducted a survey that has release that jobs in. As measured by the ratio of computer equipment and software to value added Triplett and Bosworth 2002 Table 2.

Banks ability to meet its obligations could become impaired potentially causing it to fail. They work to fix these as fast as possible so if your connection isnt working right now the best fix is often to wait a few days for Plaid to restore the connection. A bank allows a person with excess money Saver to deposit his money in the bank and earns an interest rate.

Nonfinancial retailers are joining forces with banks or opening their own lending facilities outright. Banking is an industry that is not projected to go away in the near or far futurefar from it. With technology acting as a catalyst we expect to see great changes in the banking scene in the coming years.

The banking industry is in a much healthier place now than it was after the financial crisis of 2008. It would not be wrong to call it an industry in and of itself comprising of the following structure. Developments in electronic communications and software have the potential to erode the banking industry s relative monopoly over bank deposits as the nation s dominant medium of exchange.

Often reconnecting your bank account by entering your credentials again on the Banking. By the 2008 financial crisis a small number of large banks controlled most of the banking industrys assets in the US. Basic Functions in Banking.

The financial crisis accelerated an ongoing fundamental change in the banking industry as banks diversify their services to become more competitive. In contrast bank capitallargely equity stock and retained profits from earlier periodsenables a bank to absorb a certain amount of losses without failing. The need to set up the IFSB was felt 11 years after the establishment of AAOIFI due to the broader recognition by the Islamic finance industry that the Basel Committee standards on banking supervision cannot be applied as is on Islamic banks.

For this reason bank regulators require banks to hold certain. You build up a lot of core skills like analysis logical reasoning relationship management industry knowledge people and time management etc. Learn how banks get their funds and how they make money on services.

Four trends change the banking industry world over viz. While it is true that due to reasons like internet banking and virtual banking services the industry has taken a hit the companies and organizations still remain stronger. These important secondary functions of banks are explained below.

Till this time the Bankers used to the follow the 4-6-4 method Borrow at 4. Readers may be aware that the Basel Committee on Banking Supervision is an international. He is responsible for all industry services solutions resources and ecosystem alliances across Deloittes business groups.

C Does not involve itself too much with one industry only because if that industry fails the banks assets may become frozen. Agency Functions The bank acts as an agent of its customers. Safeguarding transferring lending and exchanging money in various forms along with evaluating the credit-worthiness of customers are the main functions that banks perform.

Banking is an integral part is the most IT-intensive industry in the US. Banks and other institutions play this critical role by performing services essential to the functioning of an economy. 1 Consolidation of players through mergers and acquisitions 2 Globalisation of operations 3 Development of new technology and 4 Universalisation of banking.

Mark is a Deloitte vice chair and leads the Banking Capital Markets practice in the US. Letting customers open up lockers. Thus the banks act as an intermediary between the saver.

If it hadnt the banks failures would have threatened the US. This bank is the highest in the pecking order of any national economy holding regulatory powers to supervise the functioning of the national restricted to a country banking industry. Banking Industry Value Chain.

Time and again people have said a lot of hodgepodge about the banking industry.

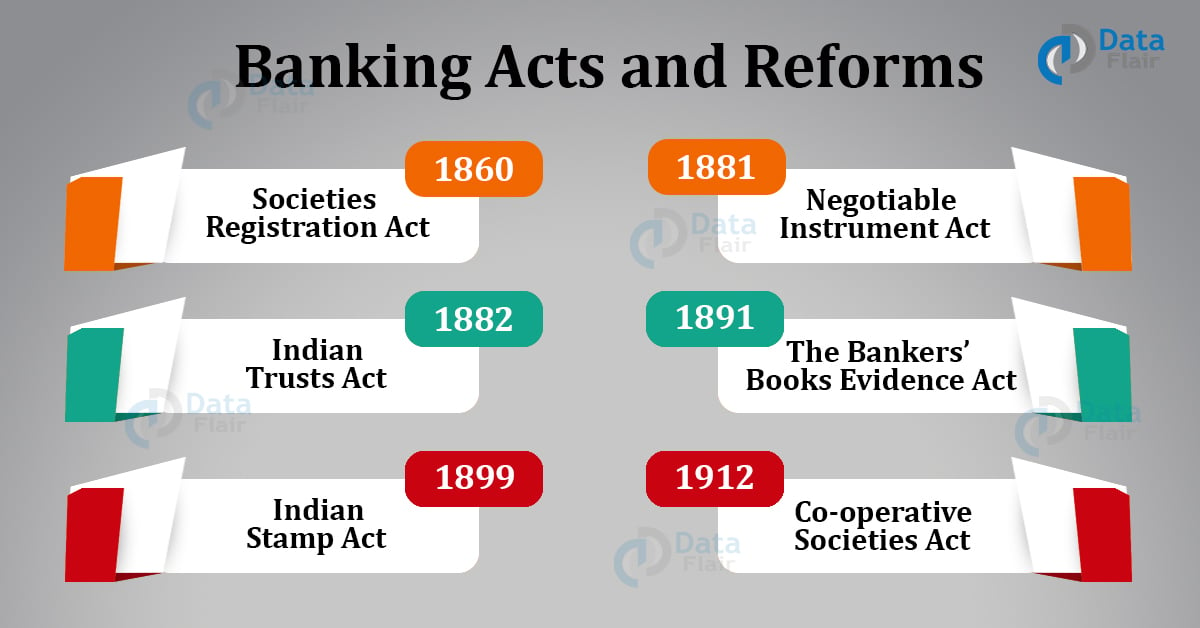

Important Banking Sector Reforms And Acts In India Dataflair

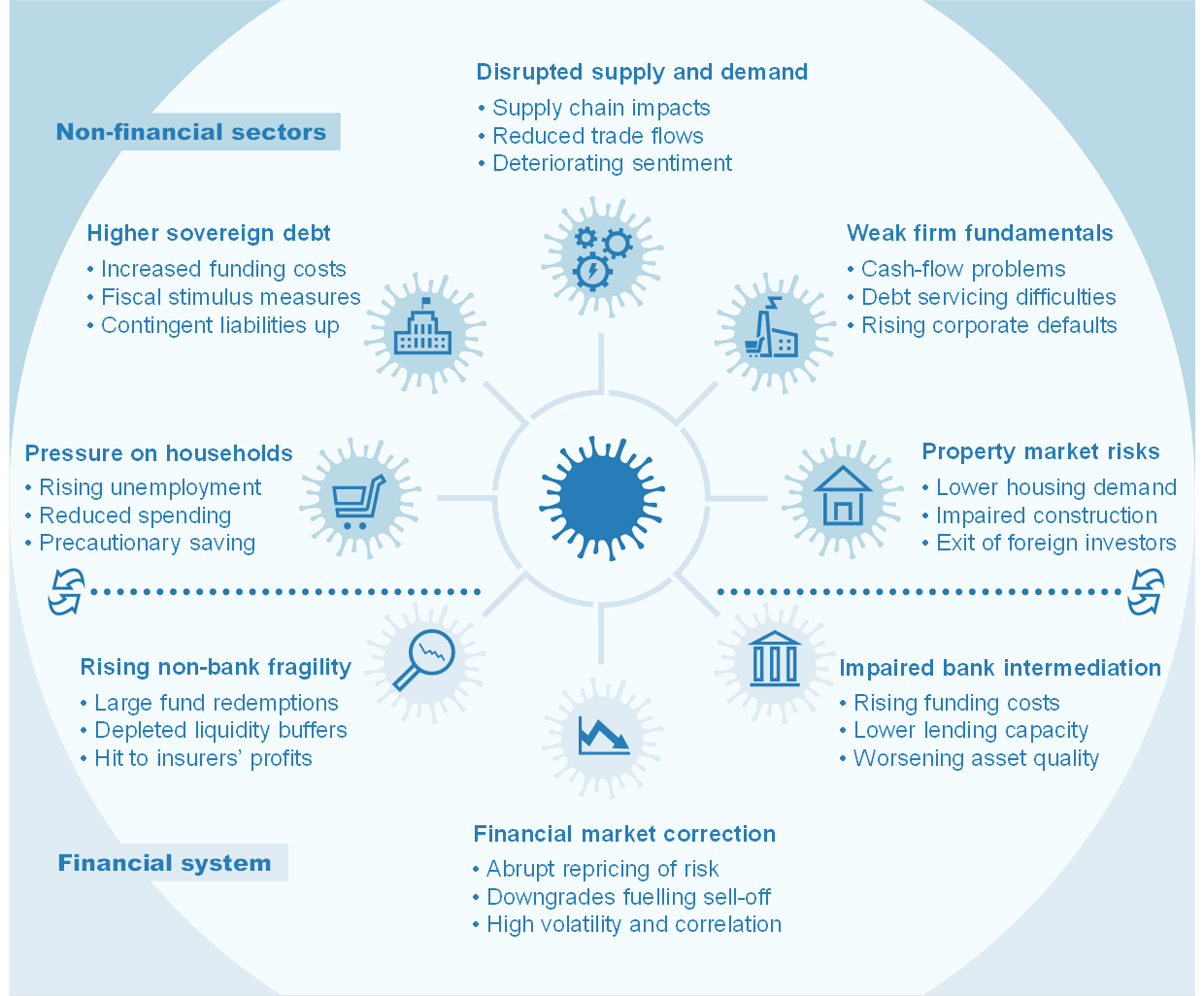

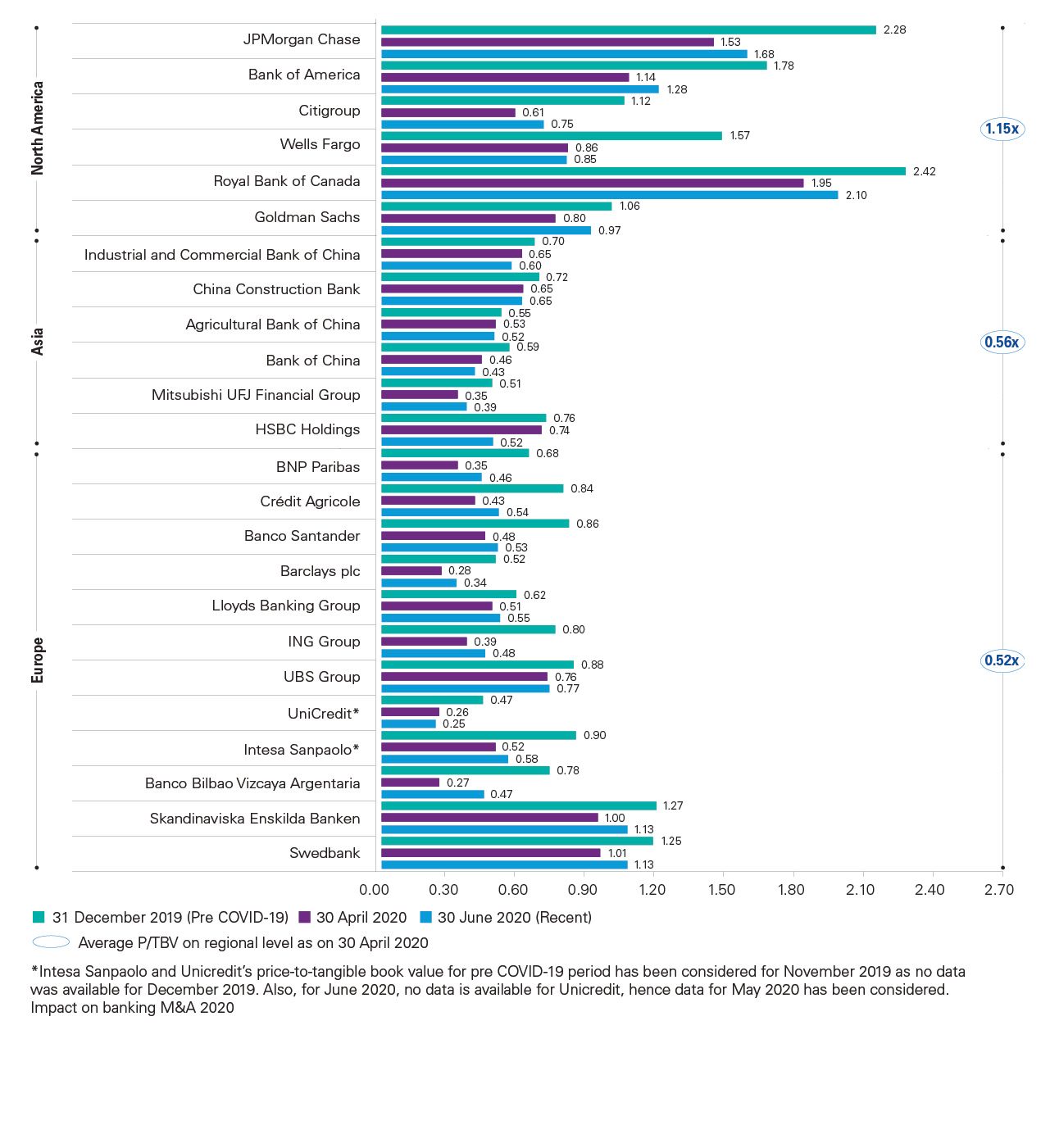

Covid 19 Impact On The Banking Sector Kpmg Global

Education What Is The Fed Supervision And Regulation

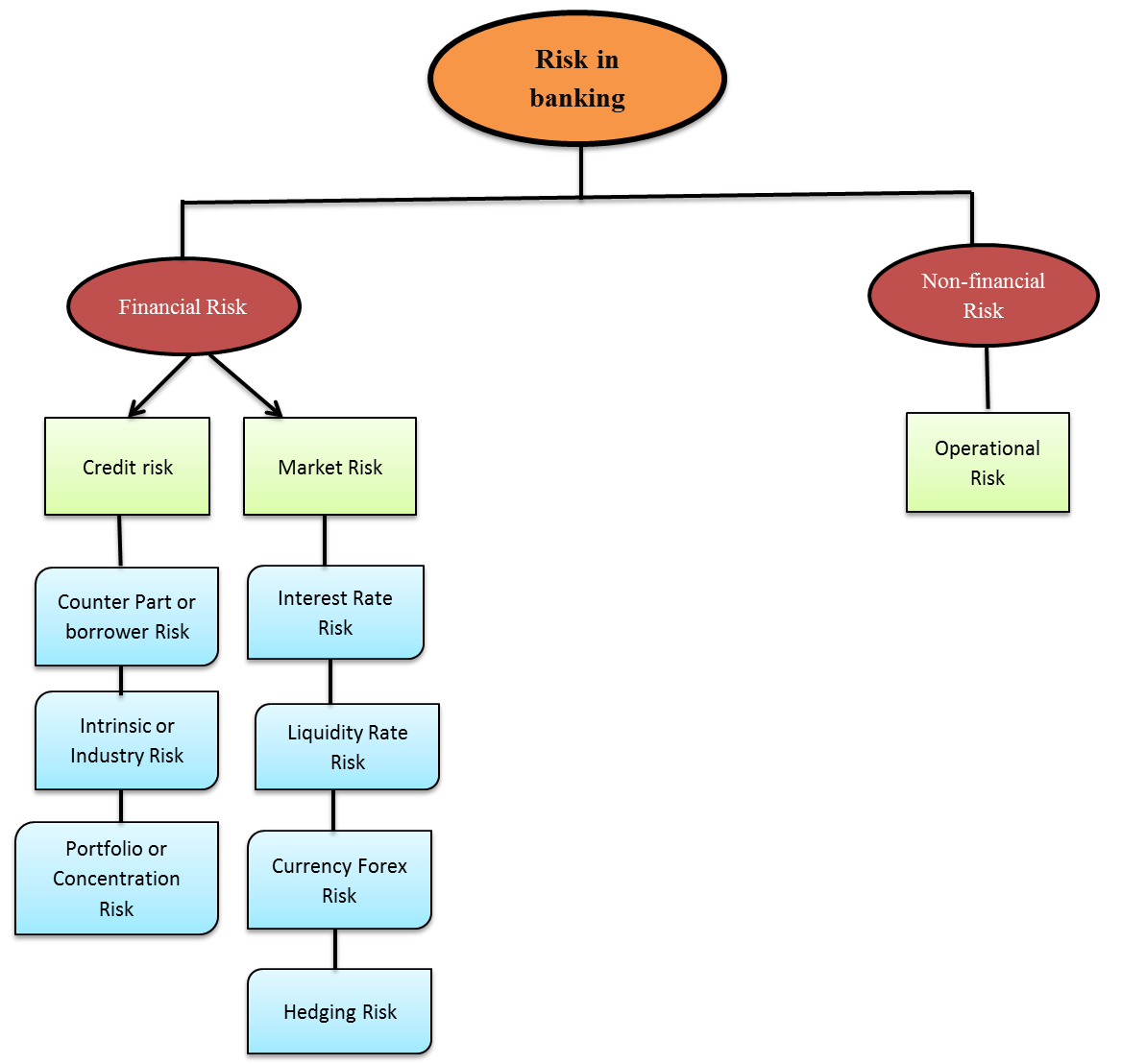

Risk Management In Banks Introducing Awesome Theory

Covid 19 Impact On The Banking Sector Kpmg Global

Combating Covid 19 How Should Banking Supervisors Respond Imf Blog

Risk Management In Banks Introducing Awesome Theory

Belum ada Komentar untuk "BANKING INDUSTRY NOT FUNCTIONING"

Posting Komentar